Is Now the Right Time to Invest in Manhattan Real Estate? The Trends You Need to Know.

Timing is Everything. A must-read Guide.

In the real estate market, timing is key. Many investors wonder if now is the right time to invest in Manhattan real estate, especially considering the recent trends and market conditions. From the impact of the pandemic to the current buyer's market, understanding the current state of the market is crucial for making informed investment decisions. Let's delve into the trends that have been shaping the Manhattan real estate market, including the buyer's market, market recovery, interest rates, rental market, and limited inventory.

A panoramic view of Manhattan skyline with a focus on high-rise buildings and luxury apartments.

Key Takeaways:

- Despite the pandemic, the Manhattan real estate market has seen a strong recovery, with record sales volume.

- The current market conditions favor buyers, with limited inventory and high mortgage rates.

- Investing in Manhattan real estate offers the potential for long-term appreciation and high rental yields.

- Understanding market trends and timing is crucial for successful real estate investment in Manhattan.

- Consider the buyer pool, interest rates, and inflation when assessing investment opportunities in Manhattan real estate.

The Historical Context: Market Slowdown and Covid Impact

In order to understand the current state of the Manhattan real estate market, it is important to examine the historical context that has shaped its recent trends. From mid-2017 through 2019, the market experienced a significant slowdown, following a typical property cycle pattern. This slowdown was influenced by factors such as decreased tax deductibility on primary residence property, increased mansion tax, oversupply in the high-end segment, and increased inventory.

The market faced additional challenges in 2020 when the Covid pandemic hit, causing a standstill in real estate activity and a significant impact on the rental market. Uncertainty surrounded the duration and impact of the pandemic, resulting in a bottoming out of the Manhattan market in mid-2020.

"The market experienced a slowdown from mid-2017 through 2019, influenced by factors such as decreased tax deductibility on primary residence property, increased mansion tax, oversupply in the high-end segment, and increased inventory."

Market Recovery and Record Sales Volume in 2021

After the challenging year of 2020, the Manhattan real estate market bounced back in 2021 with a remarkable recovery. Several factors contributed to this resurgence, including low mortgage rates, pent-up demand, and overall optimism about the New York economy.

The low mortgage rates made buying a property more affordable, attracting a larger pool of potential buyers. This, coupled with the pent-up demand from individuals who had temporarily left Manhattan during the pandemic, resulted in a surge in sales volume. Many people recognized the value of owning property in Manhattan and saw the opportunity to return to the city they love.

The sales market thrived, and this positive momentum also brought stability to the rental market. As more people returned to Manhattan, the demand for rental properties increased, creating a favorable environment for landlords.

The year 2021 concluded with record-high sales volume, marking an exceptional achievement for the Manhattan real estate market. This significant recovery and the record sales volume demonstrate the resilience and attractiveness of investing in Manhattan real estate.

The Current Manhattan Property Market in 2022 and 2023

As we enter 2022, the Manhattan property market has undergone a significant shift towards a buyer's market in the second half of the year. This shift can be attributed to the increase in mortgage rates driven by the Federal Reserve's efforts to combat inflation. However, it's worth noting that inflation levels have started to decrease, and mortgage rates have stabilized to a certain extent. Despite the stabilization, high mortgage rates have impacted the buyer pool relying on mortgage financing, causing some buyers to delay their purchasing decisions.

Another critical factor influencing the current Manhattan property market is the limited inventory. Sellers are hesitant to list their properties while the market is weak, resulting in fewer options for buyers. The limited inventory creates a challenging environment for buyers, as they have limited choices and may have to compete for the available properties. This limited supply has contributed to the shift towards a buyer's market, as buyers have more negotiating power in their transactions.

To better understand the current market dynamics, let's take a look at the table below:

| Market Indicator | 2022 | 2023 |

|---|---|---|

| Buyer's Market | Yes | Yes |

| Mortgage Rates | Increase | Stabilized |

| Inflation | High | Decreasing |

| Mortgage Financing | Challenging | Challenging |

| Limited Inventory | Yes | Yes |

The table highlights the key aspects of the current Manhattan property market, including the buyer's market status, mortgage rate trends, inflation levels, mortgage financing challenges, and limited inventory. These factors collectively shape the current market conditions and are important considerations for buyers and investors alike.

Buyer's Market: What Does It Mean?

A buyer's market, as indicated in the table, refers to a market condition where there are more properties available for sale than there are buyers. This situation gives buyers an advantage in negotiations, as sellers may be more willing to accommodate their demands. In a buyer's market, buyers have more options to choose from, and they can take their time to find the right property without feeling rushed. However, it's important to note that even in a buyer's market, prices may not necessarily decrease significantly, and sellers may still expect reasonable offers.

Market Overview up to October 2023

Median Sale Price: $998K -16% YoY

Median Price Per Sqft: $1,385 -5.5% YoY

No. of Transactions: 2,970 78.5% YoY

New York City Median Sale Price: $715K -7% YoY

What is the median sale price and median price per sq ft in Manhattan? The median home sale price in Manhattan as of August was $998K, down 16% year-over-year. A total of 2970 assets were sold, representing a 78.5% growth compared to August last year. The median price per square foot was $1,385, a -5.5% YoY change. In August, the median home sale price in New York City was $715K.

Top Boroughs in New York City

Manhattan median price compared with other neighborhoods in New York City

- Bronx: $315,000

- Queens: $515,000

- Staten Island: $635,000

- NYC Median: $715,000

- Brooklyn: $784,052.5

- Manhattan: $998,875

Manhattan property values are on the higher-end among all boroughs in NYC.

Most Expensive Neighborhoods in Manhattan

Neighborhood | Borough | Median Sale Price

-

- Central Park South: Manhattan – $6,250,000

- Hudson Yards: Manhattan – $6,164,125

- SoHo: Manhattan – $2,946,750

- Hudson Square: Manhattan – $2,695,000

- TriBeCa: Manhattan – $2,495,000

Residential Properties Sold in Manhattan

Property Type | Median Sale Price | Y-o-Y Median Sale Price Change | Y-o-Y Median Sale Price Per Sqft Change | Transactions

- Condos: $1.6M -1.5% $1K -2.2% 1171

- Coops: $750K -8.5% $963 -6.6% 1785

- Houses: $6.5M -11.1% $2K 88.1% 14

The median house sale price in Manhattan in August was $6.5M, down 11.1% year-over-year. However, median condo prices in Manhattan remained flat year-over-year at $1.6M. The median coop sale price in Manhattan was $750K, a change of -8.5% year-over-year.

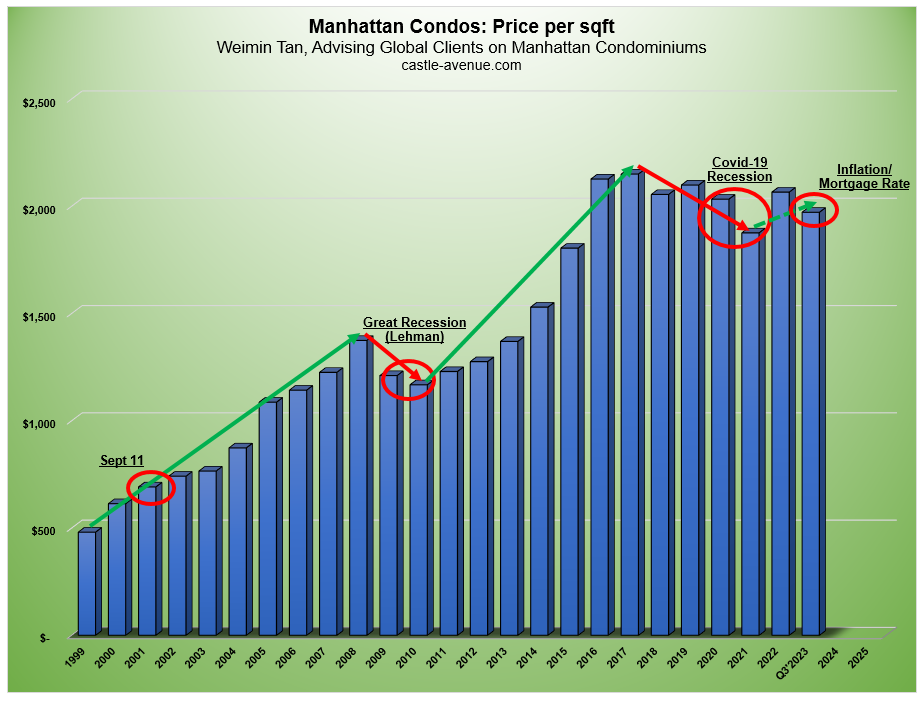

Manhattan Residential Condo Prices and Rental Yields

When considering investing in Manhattan real estate, it's important to analyze the prices of residential condos and the potential rental yields. Understanding the current market trends and fluctuations can provide valuable insights for investors looking to make informed decisions.

As of Q3 2023, the average price, price per square foot, and median price for residential condos in Manhattan have shown slight declines compared to the previous year. While this may indicate a temporary dip in prices, it's essential to consider the broader market dynamics and historical trends before drawing conclusions.

"The market for Manhattan residential condos has seen fluctuations over the years, with recent declines in prices. However, these fluctuations might be temporary, and investors should consider the long-term potential for price appreciation and rental income."

The Rental Market in Manhattan

On the other hand, the rental market in Manhattan has experienced notable increases, with record-high rents and rental yields. This can present opportunities for investors looking to generate strong rental income. It's important to assess the demand for rentals in specific neighborhoods and analyze rental yield performance to maximize investment returns.

The demand for rentals in specific neighborhoods is high, but the number of new leases fell 14% in August, marking the second-straight month of declines. This suggests that while asking rents for new leases are high, renters are balking at the prices.

| Year | Average Price | Price per Square Foot | Median Price | Number of Transactions |

|---|---|---|---|---|

| 2022 | $1,250,000 | $1,775 | $1,100,000 | 1,500 |

| 2023 | $1,200,000 | $2,025 | $1,675,000 | 1,171 |

The average price per square foot in 2022 was $1,775 and increased to $2,025 in 2023. The median price in 2023 was $1,675,000. The number of transactions in 2023 was 1,171.

Investors should consider the trends and projections in both condo prices and rental yields to evaluate the potential profitability of their investment. It's important to conduct thorough market research, analyze historical data, and stay informed about the latest developments in the Manhattan real estate market.

International Demand for Manhattan Property

In recent years, Manhattan has become a sought-after destination for international clients looking to diversify their assets and find stable investment opportunities. Alongside London, Manhattan is considered one of the Alpha++ cities in the world, making it an attractive choice for real estate investment.

The international demand for Manhattan property has seen a significant increase during the pandemic, as investors recognize the potential for price stability and long-term growth in this iconic city. With its vibrant culture, diverse economy, and strong real estate market, Manhattan offers a unique combination of factors that make it an appealing choice for international buyers.

Asset Diversification and Price Stability

One of the primary reasons international clients are drawn to Manhattan is the opportunity for asset diversification. Investing in Manhattan real estate allows investors to expand their portfolio beyond their home country and gain exposure to a different market with potential returns.

Additionally, Manhattan offers price stability, which is particularly attractive to investors seeking a safe haven for their capital. The city's strong real estate market, combined with its global reputation as a financial and cultural hub, provides a sense of security and confidence to international buyers.

Manhattan and London: Alpha++ Cities for Real Estate Investment

Both Manhattan and London have established themselves as Alpha++ cities, meaning they are considered global hubs for finance, culture, and commerce. These cities consistently attract high levels of investment due to their economic stability and potential for long-term growth.

Investing in Manhattan or London real estate offers investors the opportunity to be part of these thriving markets, with the potential for significant returns. Whether it's a residential property, commercial space, or a mixed-use development, both cities offer a wide range of investment options to suit various investment strategies and risk profiles.

Conclusion

The international demand for Manhattan property continues to grow, driven by the desire for asset diversification and the prospect of price stability. As one of the Alpha++ cities, Manhattan is an ideal choice for international investors looking to capitalize on the opportunities offered by the global real estate market. With its strong market fundamentals and reputation as a stable and lucrative investment destination, Manhattan remains an attractive option for those seeking to invest in prime real estate.

Investing in Manhattan Property: Considerations and Opportunities

When it comes to investing in Manhattan property, there are several key factors to consider. Understanding the profit potential, property types, neighborhoods, market cycles, timing, amenities, future development, ROI, and financing options is essential for making informed investment decisions. Let's explore these considerations and the opportunities that exist in the dynamic Manhattan real estate market.

Property Types and Neighborhoods

In Manhattan, there is a diverse range of property types to choose from, including condos, coops, and houses. Each property type has its own set of advantages and considerations. Condos, for example, offer a low-maintenance lifestyle and amenities, while coops often have more stringent approval processes but can offer unique investment opportunities. When considering neighborhoods, factors such as proximity to amenities, transportation, and potential for future growth should be taken into account.

Market Cycles and Timing

Like any real estate market, Manhattan experiences cycles of growth and decline. Understanding the current market cycle and timing your investment accordingly can greatly impact your returns. It's important to analyze historical data, market trends, and economic indicators to identify buying opportunities. Keep in mind that the Manhattan market has shown resilience and long-term appreciation, making it an attractive option for investors with a longer time horizon.

Amenities, Future Development, and ROI

Investing in properties with desirable amenities can attract high-quality tenants and potentially command higher rental prices or sales values. Additionally, keeping an eye on future development plans and infrastructure improvements in the area can indicate potential for increased property values. Ultimately, the return on investment (ROI) will depend on a combination of factors, including rental income, property appreciation, and expenses.

Financing Options

When it comes to financing your Manhattan property investment, there are various options to consider. Traditional mortgages are a common choice, but alternative financing options such as portfolio lenders and private lenders may offer more flexibility, particularly for investment properties. It's important to explore different financing options and consult with professionals to determine the best approach for your investment strategy.

With careful consideration of these factors and an understanding of the unique opportunities in the Manhattan real estate market, investing in Manhattan property can be a rewarding endeavor. Whether you're looking for long-term appreciation, rental income, or a combination of both, Manhattan offers a range of options to suit different investment goals and strategies.

Manhattan Real Estate Market Trends Compared to New York State

When analyzing the Manhattan real estate market, it is important to consider its performance within the broader context of the New York State housing market. Comparing the trends and dynamics of these two markets provides valuable insights for both investors and homebuyers. Let's take a closer look at key indicators and metrics to understand how the Manhattan market compares to the statewide market.

New York State Housing Market Statistics

The New York State housing market encompasses a wide range of regions and cities, each with its own unique characteristics. Here are some important metrics to consider:

- Pending sales: The number of properties that have an accepted offer but have not yet closed.

- Closed sales: The number of properties that have been sold and closed.

- Median sales price: The middle price point where half of the properties sold for more and half sold for less.

- Average sales price: The average price of all properties sold.

- Sale-to-list price ratio: The percentage of the listing price that the property ultimately sells for.

- Days on the market: The average number of days it takes for a property to sell.

- Inventory: The number of properties available for sale.

While these statistics provide a general overview, it is important to note that the Manhattan market is unique in terms of its high demand, limited inventory, and luxury properties. The Manhattan market typically has higher median and average sales prices compared to the statewide market. Additionally, the sale-to-list price ratio in Manhattan tends to be higher, indicating strong buyer demand and competitive pricing.

On the other hand, the days on the market and inventory levels may vary between Manhattan and other areas of New York State. The Manhattan market often experiences shorter days on the market due to its desirability and demand, while other regions may have longer average days on the market. Inventory levels in Manhattan are typically lower, creating a more competitive market environment.

By considering these trends and comparing the Manhattan market to the statewide market, investors and homebuyers can gain valuable insights and make informed decisions regarding their real estate ventures in Manhattan.

NYC Real Estate Market Trends: Seller's Market or Buyer's Market?

Evaluating the current state of the New York City real estate market helps determine whether it favors sellers or buyers. Factors such as housing prices, the sale-to-list price ratio, days on the market, and neighborhood variances all provide indicators of market conditions. While New York City is known for high housing prices, the market may lean towards either a buyer's or seller's market based on the availability of inventory, price negotiations, and buyer demand.

Housing Prices

One crucial aspect to consider when assessing market trends is the housing prices in New York City. The average price of properties can provide insights into the market's direction. In recent years, NYC has experienced price fluctuations, influenced by various factors such as economic conditions, supply and demand dynamics, and market cycles. Monitoring price trends can help investors and homebuyers gauge the overall market climate and make informed decisions.

Sale-to-List Price Ratio

The sale-to-list price ratio is another essential metric for understanding the dynamics between buyers and sellers. This ratio compares the final selling price of a property to its initial listing price. A high sale-to-list price ratio indicates a seller's market, where buyers are willing to pay close to or even above the asking price. Conversely, a low ratio suggests a buyer's market, where sellers may need to lower their prices to attract buyers. Analyzing this ratio provides valuable insights into the level of competition and the balance of power between buyers and sellers in the NYC housing market.

Days on Market and Neighborhood Variances

The average number of days a property spends on the market can also shed light on market conditions. A shorter time on the market indicates strong buyer demand, potentially signaling a seller's market. Conversely, a longer time on the market may indicate a buyer's market, where properties take longer to sell due to a larger inventory or decreased buyer interest. Additionally, neighborhood variances play a crucial role in market trends. Different neighborhoods in NYC may exhibit varying levels of demand, price appreciation, and market activity. Analyzing neighborhood-specific data allows for a more nuanced understanding of buyer-seller dynamics.

Considering these key factors, the NYC real estate market can fluctuate between a seller's market and a buyer's market. It is essential for investors and homebuyers to stay informed about the current market conditions and trends to make well-informed decisions. Whether it's taking advantage of high demand to sell a property or finding favorable purchasing opportunities in a buyer-friendly market, understanding the dynamics of the NYC real estate market is crucial for success.

NYC Housing Market Report up to July 2023

The housing market in New York City experienced a seasonal slowdown in July 2023, but the luxury market remained strong. Luxury sellers maintained an advantage, with luxury prices escalating and limited discounting. Brooklyn and Queens, on the other hand, showcased competitive markets with rising prices and limited inventory.

Despite the overall slowdown, buyer demand remained steady in the luxury segment, driving up prices and creating a favorable selling environment for luxury sellers. The limited discounting indicates high demand in this market, with buyers willing to pay a premium for luxury properties in New York City.

In Brooklyn and Queens, the market remained competitive with rising prices and limited inventory. These boroughs continue to attract buyers looking for more affordable options outside of Manhattan. The combination of limited supply and strong demand has led to upward pressure on prices, making it a seller's market in these areas.

| Market Segment | Price Trend | Inventory | Buyer Demand |

|---|---|---|---|

| Luxury Market | Escalating prices | Limited discounting | Steady demand |

| Brooklyn | Rising prices | Limited inventory | High demand |

| Queens | Rising prices | Limited inventory | Strong demand |

The July 2023 housing market report reflects the dynamic nature of the New York City real estate market. While the overall market experienced a seasonal slowdown, the luxury segment and certain boroughs continued to showcase strength and competitiveness. These trends highlight the importance of staying informed and understanding the specific dynamics of different segments and neighborhoods within New York City when considering buying or selling property.

NYC Real Estate Market Forecast 2023-2024

As we look ahead to the future of the New York City real estate market, it is important to consider various factors that will shape the market dynamics and influence homeownership and renting trends. Predicting the market with certainty is challenging, but by analyzing historical trends and understanding supply and demand dynamics, we can make informed predictions about the NYC real estate market for 2023 and 2024.

One key aspect to consider is NYC home prices. Historically, New York City has seen steady appreciation in home prices, driven by its desirability and limited supply. While there may be fluctuations across neighborhoods, overall, NYC home prices are expected to continue their upward trajectory in the coming years. This trend can be attributed to high demand from both local and international buyers, as well as the city's status as a global financial hub.

Supply and demand dynamics will also play a crucial role in shaping the market. As demand for housing in NYC remains strong, limited inventory can drive up prices in certain neighborhoods. Developers and investors will continue to look for opportunities to meet the growing demand, but it may take time to balance the market and increase supply. This imbalance between supply and demand could contribute to a competitive marketplace, with multiple offers and bidding wars becoming more common.

When considering the forecast for 2023 and 2024, it is important to recognize that NYC is a city of neighborhoods, each with its own unique market dynamics. While some neighborhoods may experience significant growth and price appreciation, others may see more modest gains or even a slight decline. Buyers and investors should carefully evaluate neighborhood trends, including development plans, infrastructure improvements, and amenities, to make informed decisions about where to invest.

In terms of homeownership and renting, the preference for each will continue to vary based on individual circumstances and market conditions. While NYC has traditionally been a city with a high percentage of renters, the desire for homeownership may increase as the city recovers from the pandemic and buyers seek stability and long-term investment opportunities. However, renting will remain a popular option for many residents, offering flexibility and the ability to experience different neighborhoods without the commitment of buying a property.

| Forecast Highlights: | 2023 | 2024 |

|---|---|---|

| Home Price Growth | Steady appreciation across most neighborhoods | Continued upward trajectory with variations by neighborhood |

| Supply and Demand | Limited inventory, competitive market | Gradual increase in supply, potential for more balanced market |

| Neighborhood Variations | Different neighborhoods experience varying levels of growth | Continued variation in neighborhood performance |

| Homeownership vs. Renting | Preference for renting remains strong, but growing interest in homeownership | Similar trends to 2023, with some shift towards homeownership |

While this forecast provides valuable insights into the trends and market dynamics that may shape the NYC real estate market in the coming years, it is crucial to regularly monitor market updates and consult with real estate professionals for the most up-to-date information. By staying informed and understanding the nuances of the market, investors and homebuyers can position themselves for success in the ever-changing landscape of the New York City real estate market.

Conclusion

In my assessment of the current trends and market conditions, I believe that investing in Manhattan real estate presents promising opportunities. Despite market fluctuations, including the recent buyer's market and the impact of the pandemic, the overall outlook remains positive for the Manhattan property market.

One of the key factors that make Manhattan an attractive investment option is the high rental yields it offers. With limited inventory and a history of price appreciation, the potential for returns on investment is significant. Whether you are considering residential condos, coops, or houses, Manhattan's real estate market provides a range of options for investors.

It's crucial to consider long-term goals and market dynamics when making investment decisions in Manhattan. The location-specific factors, such as property types, neighborhoods, and future development plans, play a vital role in determining the profit potential of your investment.

Overall, the Manhattan real estate market is well-positioned for investors seeking real estate investment opportunities. With its strong rental market, limited inventory, and a global reputation as a stable and lucrative market, Manhattan offers the potential for long-term growth and profitability.

FAQ

Is now the right time to invest in Manhattan real estate?

The current trends and market conditions suggest that investing in Manhattan real estate can present opportunities for investors. While the market has experienced fluctuations, including a recent buyer's market and pandemic impact, the overall outlook remains positive. With high rental yields, limited inventory, and a history of price appreciation, Manhattan continues to attract investors looking to capitalize on the opportunities in the property market. It's important to consider long-term goals, market dynamics, and location-specific factors when making investment decisions in Manhattan real estate.

What were the trends in the Manhattan real estate market during the pandemic?

The Manhattan real estate market experienced a slowdown from mid-2017 through 2019, following a typical property cycle pattern. This slowdown was influenced by factors such as decreased tax deductibility on primary residence property, increased mansion tax, oversupply in the high-end segment, and increased inventory. In 2020, the market was hit hard by the Covid pandemic, leading to a standstill in real estate activity and a significant impact on the rental market. The market reached its bottom in mid-2020, with uncertainty surrounding the duration and impact of the pandemic.

How did the Manhattan real estate market recover in 2021?

Following the bottom in mid-2020, the Manhattan real estate market experienced a strong recovery in 2021. Low mortgage rates, pent-up demand, and overall optimism about the New York economy led to a surge in sales volume, reaching record highs. People who had moved out of Manhattan during the pandemic started returning, driving the sales market and bringing stability to the rental market. The year 2021 ended with the highest sales volume ever recorded in Manhattan.

What is the current state of the Manhattan property market in 2022 and 2023?

The Manhattan property market shifted to a buyer's market in the second half of 2022, influenced by the increase in mortgage rates driven by the Federal Reserve's efforts to combat inflation. Limited inventory has been a challenge in the current market, with sellers choosing not to list their properties while the market is weak. It's important to note that the buyer pool relying on mortgage financing is currently off the market due to high mortgage rates.

What are the prices and rental yields for Manhattan residential condos?

The prices of Manhattan residential condos have seen fluctuations over the years. From a peak in 2017, there was a decrease in condo prices in recent years. As of Q3 2023, the average price, price per square foot, median price, and number of transactions for residential condos have shown slight declines compared to the previous year. On the other hand, the rental market has seen notable increases, with record-high rents and rental yields. Investors have been experiencing strong rental yields with the rent increases in the Manhattan market.

Is there international demand for Manhattan property?

Yes, Manhattan has been a popular destination for international investors seeking asset diversification and price stability. It is often considered one of the top cities in the world for real estate investment, along with London. The global demand for Manhattan property has increased during the pandemic, with international clients taking advantage of favorable terms and the reputation of Manhattan as a stable and lucrative real estate market.

What factors should be considered when investing in Manhattan property?

Investing in Manhattan property requires careful consideration of factors such as profit potential, property types (condos, coops, houses), neighborhoods, market cycles, timing, amenities, and future development plans. The potential for a return on investment (ROI) is influenced by factors like location, market trends, property condition, and financing options. Opportunities exist for investors looking to capitalize on the unique characteristics and desirability of Manhattan real estate.

How does the Manhattan real estate market compare to the broader New York State housing market?

The Manhattan real estate market is part of the larger New York State housing market. Comparing the trends in the Manhattan market to the statewide market provides valuable insights. Areas such as pending and closed sales, median and average sales prices, sale-to-list price ratio, days on the market, and inventory levels can be analyzed to understand the specific dynamics of the Manhattan market within the broader context of the state.

Is the NYC real estate market currently a seller's market or a buyer's market?

Evaluating the current state of the New York City real estate market helps determine whether it favors sellers or buyers. Factors such as housing prices, the sale-to-list price ratio, days on the market, and neighborhood variances all provide indicators of market conditions. While New York City is known for high housing prices, the market may lean towards either a buyer's or seller's market based on the availability of inventory, price negotiations, and buyer demand.

What were the trends in the NYC housing market in July 2023?

The housing market in New York City experienced a seasonal slowdown in July 2023, but the luxury market remained strong. Luxury sellers maintained an advantage, with luxury prices escalating and limited discounting. Brooklyn and Queens, on the other hand, showcased competitive markets with rising prices and limited inventory. Assessing the housing market performance on a monthly basis provides insights into the dynamics of specific segments and neighborhoods within New York City.

What is the forecast for the NYC real estate market in 2023 and 2024?

Forecasting the New York City real estate market for 2023 and 2024 involves considering factors such as historical trends, supply and demand dynamics, neighborhood performance, and the preference for homeownership versus renting. The NYC market has a reputation for long-term appreciation, with rising home prices and strong demand. However, the market can experience variations across neighborhoods and housing types, making comprehensive analysis and updated forecasts essential for investors and homebuyers.

Source Links

- https://www.castle-avenue.com/is-now-a-good-time-to-invest-in-manhattan-new-york-residential-property.html

- https://www.noradarealestate.com/blog/new-york-real-estate-market/

- https://www.noradarealestate.com/blog/manhattan-real-estate-market/

- https://www.propertyshark.com/mason/market-trends/residential/nyc/manhattan